Universal bank reconciliation tool: a configurable solution designed for businesses of all industries and sizes, ReconArt ensures accurate matching of bank statement transactions with internal financial records like the cash accounts of the General Ledger

Overcomes complex reconciliation challenges and removes typical bottlenecks: handles high transaction volumes, varied bank statement formats, multi-currency transactions, and complex relationships (e.g., matching one-to-many, many-to-many)

Full automation of all reconciliation steps: AI-enhanced data import and transformation, rule-driven matching, exception classification and reporting, integration of multiple data sources

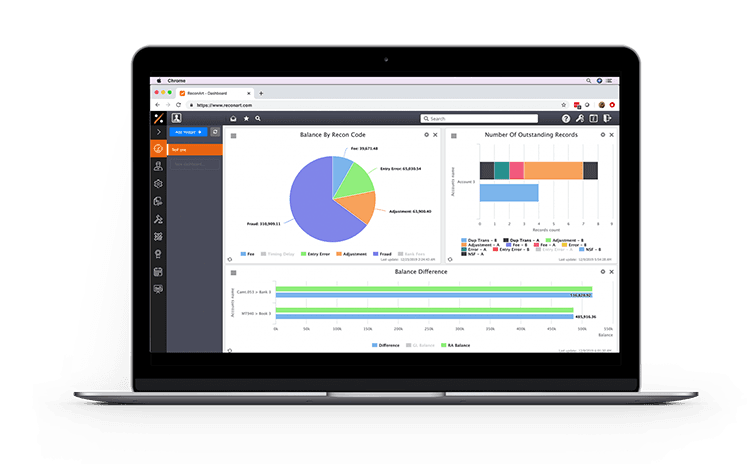

Exception management and compliance: provides instant visibility into discrepancies (bank fees and taxes, deposits in transit, delays, reversals, etc), enabling quick resolution of outstanding within an auditable framework and best-practice reporting

Broad Format Support: compatible with standard bank statement formats (like CSV, XLSX, BAI, ACH, SWIFT MT, camt.053) and custom or proprietary formats

Bank Reconciliation

Significant time savings: end-to-end automation the bank reconciliation process reducing manual efforts at month-end close and giving finance teams more time to focus on strategy and analysis

A business user-friendly interface with no IT expertise required for set-up or daily operations

Enhanced compliance and control on cash balances: auditable workflows and matching logic, transaction-level history, supporting documentation

Seamless integration with ERPs and internal accounting systems, as well as unlimited external data sources like financial messaging platforms and bank statement feeds

Scalability and flexibility: designed to adapt quickly to business changes, accommodating increased transaction volumes, bank accounts, and currencies.

By implementing ReconArt’s bank reconciliation software, businesses can achieve continuous accounting capabilities, improve compliance and internal controls, and ensure accuracy in financial reporting while scaling effortlessly as their needs grow.

ReconArt Customer Success Stories

ReconArt is proud to receive the trust of our customers and we are dedicated to our mutual success. Here are some of the customers who leverage our reconciliation software to automate their reconciliation and close processes.

First National Bankers Bank

FNBB achieves up to 80% time savings with automated bank reconciliation

First National Bankers Bank (FNBB), headquartered in Baton Rouge, Louisiana, was chartered as the first national Bankers Bank in the United States in 1984.

Banco Unico (now Nedbank Mozambique)

Nedbank streamlines complex transaction matching and journal entry controls

Banco Unico (now Nedbank Mozambique), the fifth largest bank in Mozambique, has earned a reputation of an innovative, dynamic and client oriented financial institution

Case Study: New Generation Online Bank

Online bank enhances bank reconciliation and exceptions management with ReconArt

The Client is an online bank – a new generation banking institution that strives to make a difference through technology.

Let's Talk

We welcome the opportunity to explore your needs and introduce you to our solution.

Quick response

Collaborative discovery

Transparency and openness

Clear next steps